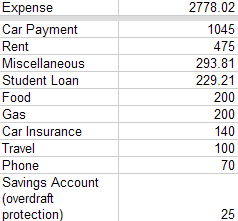

In the last two posts, I shared my budget and categories of spending that were non-negotiable and maybe negotiable. Today we will cover the part of my budget where I have the most flexibility/options.

Every month, I will spend $293.81 for my most negotiable spending category: Miscellaneous!

Every month, I will spend $293.81 for my most negotiable spending category: Miscellaneous!

The amount available for miscellaneous expenses has increased by $200 recently because of a change in my car payment ($1245 to $1045). What exactly qualifies as “miscellaneous”? Pet expenses (I have two furry friends** that require food and litter), storage rental (I’m hoping to lose this expense SOON; a little more about this later), entertainment, gifts, airfare to see my sweetheart and occasional car maintenance (think oil changes and car wash). **I wish my cats were as cool as these two...

Although I like to think that my budget in reality reflects exactly what’s on this spreadsheet, the sad truth is that I occasionally use my credit card to make purchases.....and I often don’t pay the balance in full every month (YIKES!) What’s not-so-sexy about this idea is that I know interest charges are lost opportunity costs. Having looked at my credit card statements for the past 8 billing cycles (starting since January 11, 2010), I’ve paid $59.11 in credit card interest. That’s enough money to fill up my gas tank and buy a decent lunch! Fortunately, the miscellaneous category of expenses also includes me taking a stab at whatever credit card balance exists, so it’s not an ever-growing ball of debt.

Now about that storage unit...

I’m working on getting a nice chunk of money from selling all of what I have (it’s mostly furniture), but I am more excited at the prospect of reclaiming $97 a month (bye-bye monthly storage payment; hello more money for saving, expenses, credit card balance elimination, etc.!). I’ve posted items for sale on Craigslist and received a few responses, but none that adhere to the requests of the post (Hey Craigslist customers! Please read the entire post before you start emailing sellers silly questions about what’s for sale. The information is already there! Okay, gripe over :>)

At any rate, you might be wondering what my plans are for the “miscellaneous” expense category? Well, here’s where I’ll solicit your help. There are a few items on my list that I need to do and others that I’d like to do. How I will (or will not) attain such will be up to you. In the near future (9 months), I’d like to (in decreasing order of expense amount):

The amount available for miscellaneous expenses has increased by $200 recently because of a change in my car payment ($1245 to $1045). What exactly qualifies as “miscellaneous”? Pet expenses (I have two furry friends** that require food and litter), storage rental (I’m hoping to lose this expense SOON; a little more about this later), entertainment, gifts, airfare to see my sweetheart and occasional car maintenance (think oil changes and car wash). **I wish my cats were as cool as these two...

Although I like to think that my budget in reality reflects exactly what’s on this spreadsheet, the sad truth is that I occasionally use my credit card to make purchases.....and I often don’t pay the balance in full every month (YIKES!) What’s not-so-sexy about this idea is that I know interest charges are lost opportunity costs. Having looked at my credit card statements for the past 8 billing cycles (starting since January 11, 2010), I’ve paid $59.11 in credit card interest. That’s enough money to fill up my gas tank and buy a decent lunch! Fortunately, the miscellaneous category of expenses also includes me taking a stab at whatever credit card balance exists, so it’s not an ever-growing ball of debt.

Now about that storage unit...

I’m working on getting a nice chunk of money from selling all of what I have (it’s mostly furniture), but I am more excited at the prospect of reclaiming $97 a month (bye-bye monthly storage payment; hello more money for saving, expenses, credit card balance elimination, etc.!). I’ve posted items for sale on Craigslist and received a few responses, but none that adhere to the requests of the post (Hey Craigslist customers! Please read the entire post before you start emailing sellers silly questions about what’s for sale. The information is already there! Okay, gripe over :>)

At any rate, you might be wondering what my plans are for the “miscellaneous” expense category? Well, here’s where I’ll solicit your help. There are a few items on my list that I need to do and others that I’d like to do. How I will (or will not) attain such will be up to you. In the near future (9 months), I’d like to (in decreasing order of expense amount):

- Max out my Roth IRA ($3,883.75 remaining)

- Pay for a trip to the Caribbean to celebrate my girlfriend’s birthday ($500)

- Set aside money for my boyfriend’s birthday ($300)

- Buy new clothes ($250)

- Vehicle window tinting ($200-$250), and

- Repair the crack in my windshield (I’m guessing $100-$200).

Let’s get started....

What need and want should I start saving for? Please select one of each and post your recommendation in the comment section. Thanks =)

No comments:

Post a Comment